Specialists in R&D

R&D Tax Credits

If your business has invested money to develop a new product or a service, you may be eligible to claim the R&D tax credit. We carry out 100% of your claim, deal with HMRC directly and charge you a fixed % based on the claim, if successful.

I am…

New to R&D

I’m new to R&D or have never claimed R&D Tax Credit before.

Looking to switch

I want to get the most out of my claims by partnering with Pennyhills.

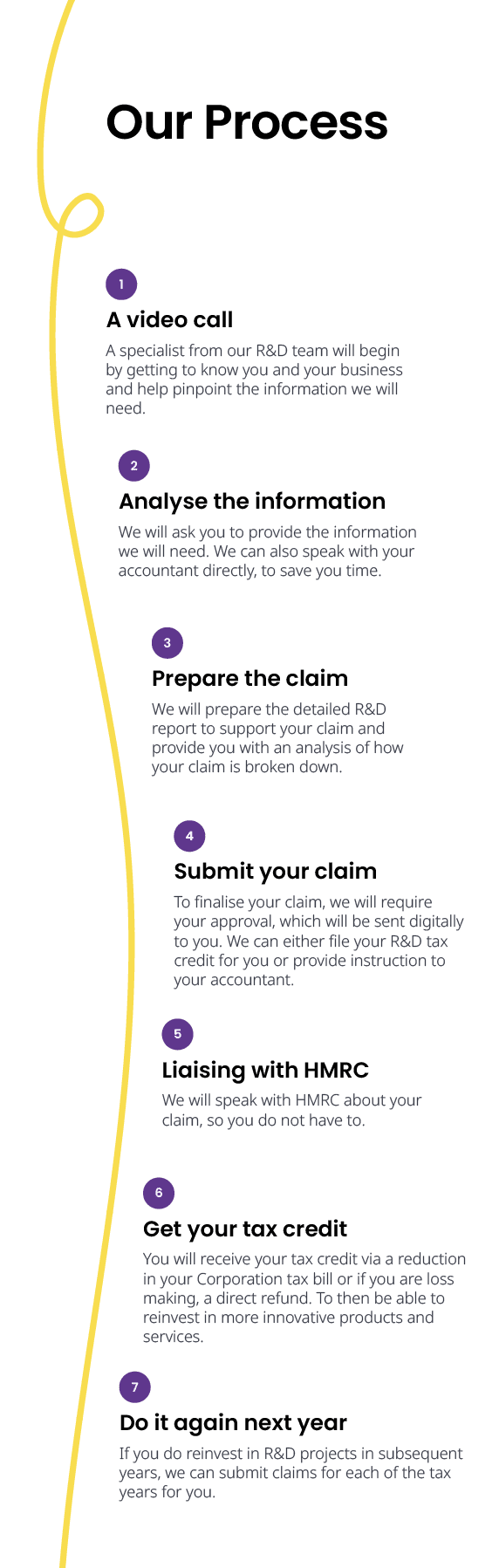

Our Process

- A video call – A specialist from our R&D team will begin by getting to know you and your business and help pinpoint the information we will need.

- Analyse the information requested – We will ask you to provide the information we will need. We can also speak with your accountant directly, to save you time.

- Prepare the claim – We will prepare the detailed R&D report to support your claim and provide you with an analysis of how your claim is broken down.

Submit your claim – To finalise your claim, we will require your approval, which will be sent digitally to you. We can either file your R&D tax credit for you or provide instruction to your accountant. - Liaising with HMRC – We will speak with HMRC about your claim, so you do not have to.

- Get your tax credit – You will receive your tax credit via a reduction in your Corporation tax bill or if you are loss making, a direct refund. To then be able to reinvest in more innovative products and services.

- Do it again next year – If you do reinvest in R&D projects in subsequent years, we can submit claims for each of the tax years for you.

R&D Tax Credits

Case Studies

Onetrace Ltd

SaaS First R&D Tax Credit Claim

NetAutomate Ltd

Taking Over R&D Tax Credit Advisory

Abex Capital Ltd