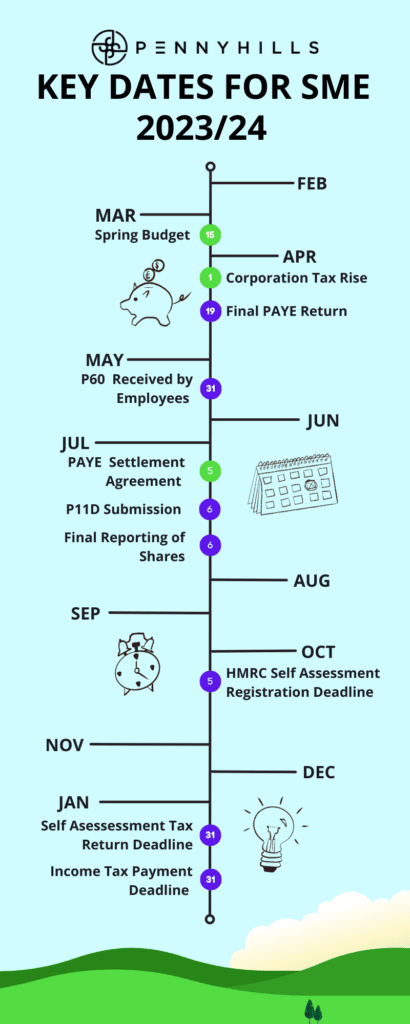

Finance Calendar 2023: Key dates for your SME and personal finances

Here’s our rundown of the key finance dates heading into 2023, and the start of 2024. We’ll cover off deadlines for PAYE, self assessment, and other tax considerations, while also covering off changes to legislation that can affect both your business, and your personal finances.

We’ve broken this down by date. Keep an eye out for handy links, either to official government websites, or to supporting blogs on the Pennyhills website, to make sure you’re prepared for the next 12 months.

Calendar

February 2023

- 2nd February: P46 Car Submission Deadline

Final day to submit P46 for employees whose car/fuel benefits changed during the quarter ending on the 5th January 2023.

March 2023

- 1st March: New advisory fuel rates

New advisory fuel rates for the upcoming quarter come into effect from this date - 15th March: Spring Budget

Chancellor Jeremy Hunt will set out fiscal and financial policy for the upcoming year.

April 2023

- 1st April: Corporation tax rate increases

Corporation tax will increase from 19% to 25% for the future financial year.

- 5th April: End of 2023 Tax Year

- 6th April: Start of 2024 Tax Year

- 19th April: Final PAYE return deadline for employers

Deadline to file final PAYE return for employers for the 2023 tax year (6th April 2022-5th April 2023)

May 2023

- 3rd May: P46 Deadline for Car/Fuel Benefit Changes (NB: Paper deadline – electronic form 5th April 2023)

Final Day to submit P46 (Car) for employees whose car/ fuel benefits changed during the quarter to 5th Apr 2023. - 31st May: P60 Deadline 2022/2023

Deadline for employees to receive their P60 (summary of tax contributions for the financial year) for 2022/2023. Late filing will incur penalty fees of £300 + £60 per day for continued late submission.

June 2023

- 1st June: New advisory fuel rates

New advisory fuel rates for the upcoming quarter come into effect from this date

July 2023

- 5th July: PAYE Settlement Agreement deadline

A PAYE Settlement Agreement (PSA) allows a business to make one annual payment to cover all the tax and National Insurance due on minor, irregular or impractical expenses or benefits attributed to your employees. You will need to write to HRMC to agree the benefits and expenses to be included, and sign and return form P626. The deadline for applying for a PSA is the 5th July, you can return the forms after this date. - 6th July: P11D Deadline for 2022/2023

Employers must submit P11D form, reporting expenses or benefits provided to employees at the end of tax year 2022/2023 - 31st July: Second payment due on self assessment for tax year 2022/23

For all individuals that pay self assessment, and have opted to split their payment, the second total due to HMRC must be paid by the end of July

August 2023

- 2nd August: P46 Deadline for Car/Fuel Benefit Changes

Final Day to submit P46 (Car) for employees whose car/ fuel benefits changed during the quarter to 5th July 2023.

September 2023

- 1st September: New advisory fuel rates

New advisory fuel rates for the upcoming quarter come into effect from this date

October 2023

- 5th October: Self-Assessment registration deadline

Deadline to submit self-assessment registration to HMRC, including income/capital gains. This is a crucial step for newly self-employed, or people filing their first tax return for the tax year 2022/2023. Here’s a full checklist for registering for self-assessment.

- 31st October: Paper Self-Assessment Tax Return Deadline for 2022/2023

November 2023

- 2nd November: P46 Deadline for Car/Fuel Benefit Changes

Final Day to submit P46 (Car) for employees whose car/ fuel benefits changed during the quarter to 5th July 2023.

December 2023

- 1st December: New advisory fuel rates

New advisory fuel rates for the upcoming quarter come into effect from this date

January 2024

- 31st January: Digital Self-Assessment Tax Return Deadline for 2022/2023

All information pertaining to self-assessment returns must be submitted with HMRC by this date. It’s strongly advisable to pass on your financial information to a trusted accountant well in advance of this date. Here’s a full breakdown of what your accountant will need to complete this task. - 31st January: Income tax payments due

First payment on Account for Income Tax is due for the financial year 2023/24 and balancing payment for 2022/23.

Sign up for our newsletter to keep fully up to date

While these dates are key touch points in the upcoming financial year, it is not an exhaustive list. Things change. For example, the upcoming budget on the 15th March, could move the goalposts for both your business and personal finances.

To keep fully up to date over the coming year, sign up for our newsletter. Every month we share advice on managing tax, growing your business and streamlining your personal finances.

To get the latest Pennyhills insights into your inbox, sign up here.